Author: Mr. Tian Yan

Background Overview

Polyether polyols are important downstream derivatives of the C3 industry chain and also one of the core raw materials for synthesizing polyurethane (PU).

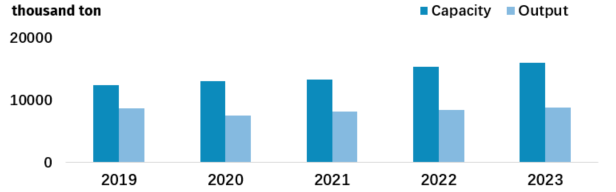

In the past five years, the total global production capacity of polyether polyols has shown a rapid growth, with an average annual growth rate of 6.5%. By 2023, the global production capacity of polyether polyols has reached nearly 16 million tons. The growth of production capacity mainly comes from the Asia Pacific region, especially China. As the world's largest producer and seller of polyether polyols, China has the fastest expansion speed of in terms of production capacity.

Whereas, the global production of polyether polyols remained relatively stable, with an average annual growth rate of 0.2% over the past five years. In 2023, its production reached approximately 8.7 million tons, returning to pre pandemic production levels. The rapid growth of global polyether polyol production capacity and the stability of its production has led to a downward trend in the industry's average operating rate.

Chart 1: Global polyether polyol production capacity and output (2019-2023)

From a global perspective, the top 10 producers account for 57% of the total production capacity, and there is still room for improvement in market concentration. It is worth noticing that among the top 5 producers, all players are foreign-funded enterprises (Dow, Covestro, Shell, BASF) except Wanhua Chemical. In addition, there is a significant gap in production capacity between the Chinese companies and the top five companies.

I. The status quo of China's polyether polyol industry

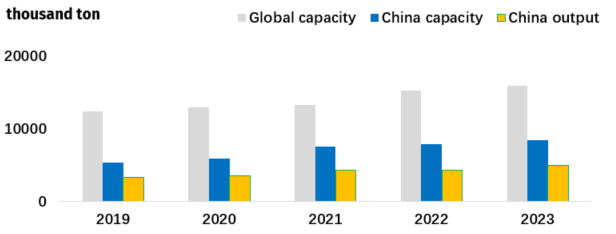

In the past five years, the average annual growth rate of polyether polyol production capacity in China has reached 12%, much higher than that of the global level (6.5%). By 2023, the production capacity of polyether polyols in China has reached approximately 8.4 million tons per year, accounting for more than half of the global total capacity.

Meanwhile, the production of polyether polyols in China has also grown rapidly, with an average annual growth rate of 11%. In 2023, the production of polyether polyols in China reach about 5 million tons. It should be noted that even though China's production has increased, the overall average operating rate of the polyether polyol industry in China is not satisfying due to the low market concentration and fierce competition among small and medium-sized enterprises with homogeneous products. In the past five years, China’s average operating rate has been lower than 60%.

Chart 2: China polyether polyol production capacity and output (2019-2023)

In the domestic polyether polyol market, the top 10 enterprises accounts for nearly 70% of the total production capacity. Compared to Europe and America where the top 5 enterprises accounting for about 90% of their market share, the market concentration in China is rather low.

With the further expansion of production capacity by domestic leading enterprises with more complete upstream industrial chain support in the future, small and medium-sized enterprises will gradually withdraw from the market, which will raise the concentration level of China's polyether polyol market.

II. Consumption and export trends of polyether polyols in China

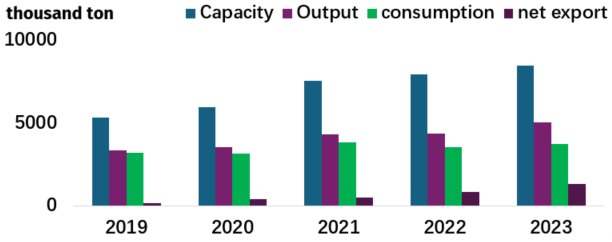

In terms of consumption, China is the world's largest consumer of polyether polyols, with an average annual consumption growth rate of 4% in the past five years, and the consumption reached approximately 3.7 million tons in 2023. The main types of polyether polyols include traditional soft foam, traditional rigid foam, POP, high resilience polyether polyols, and elastomers, and the consumption structure has remained stable.

The downstream application of different types of polyether polyol products vary. In China, rigid polyether polyols are mainly used in products such as refrigerators and freezers, followed by construction boards, transportation, and other fields. Soft foam polyether polyols are mainly used in the fields of soft furniture, vehicle seats, etc.

In the future, with the increasing demand for fresh products from consumers, industries such as cold storage and cold chain logistics will experience rapid development, which will significantly drive the consumption of rigid polyether polyols. However, the soft furniture industry in China is mature and the industry scale is growing steadily, which will lead a relatively weak consumption growth of soft foam polyether polyols.

In addition to meeting domestic demand, China also exports a large volume of polyether polyols. In 2023, the export volume of polyether polyols in China reached about 1.7 million tons. In recent years, China’s export volume of polyether polyols has increased rapidly, the main driving forces are international events such as the Russia-Ukraine conflict and the European energy crisis, which have increased production costs for overseas polyether polyol manufacturers, creating favorable conditions for Chinese enterprises to expand their export scale of polyether polyols.

However, it is also important to be aware that as the export volume of China's polyether polyols increases, it may impact the markets of countries with insufficient industrial strength. Some countries have already implemented anti-dumping policies against Chinese exports of polyether polyols, which requires enterprises with export business to constantly monitor the changes in trade policies in the target markets. For example, India's domestic production capacity of polyether polyols is less than 80,000 tons per year. To protect its domestic enterprises, India has taken anti-dumping measures against China again and again since 2003. In March 2024, the final ruling of India's anti-dumping investigation imposed 534 USD per ton anti-dumping duties on Chinese manufacturer Wanhua Chemical and 608 USD per ton on other Chinese producers. Additionally, to protect its domestic manufacturers, Brazil initiated anti-dumping investigations on various chemical products, including polyether polyols, in January 2024, and the final duty rates have not yet been determined.

Chart 3: Supply & demand of China polyether polyol (2019-2023)

III. Insights of CNCIC Consulting

At present, both the global and Chinese capacities for polyether polyols are clearly in a state of oversupply, and the industry's average operation rate is relatively low. The polyether polyol industry in developed countries is mature and has entered a phase with consolidated concentration, while China is still in the developing phase with a large number of small and medium-sized enterprises competing with homogenized products. With the expansion of leading polyether polyol enterprises and the realization of integrated industrial chain, a squeeze-out effect on small and medium-sized enterprises will manifest itself. The market concentration of China's polyether polyol industry will be further improved and it will support Chinese enterprises to enhance their competitiveness in the international market and promote the high-quality development of the overall polyether polyol industry.